After recording a record loss of N1.27 trillion in 2023, the Central Bank of Nigeria (CBN) returned to profitability in 2024 with a surplus of N38.8 billion, newly released financial statements show.

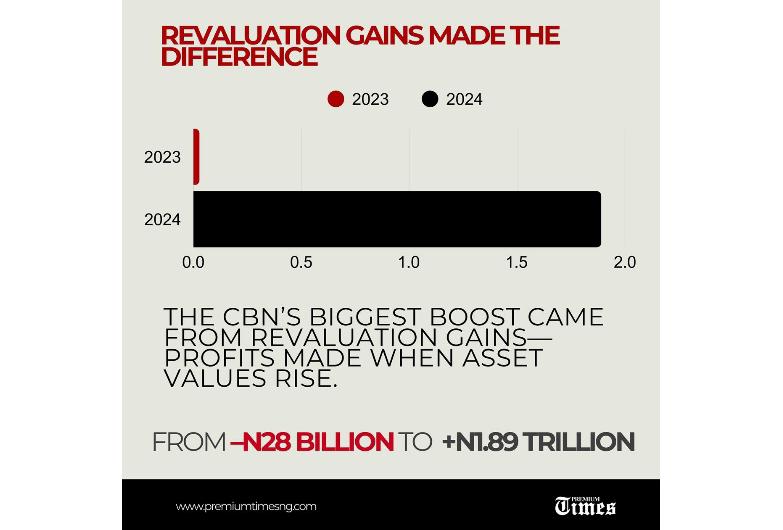

The turnaround was largely driven by a sharp rise in revaluation gains and profits made when the value of assets such as foreign reserves increased, alongside a tripling of “other income” to N12.9 trillion.

However, the central bank continued to post steep losses on derivative contracts, which ballooned to N13.88 trillion, more than double the previous year’s figure. The report did not provide a breakdown of the contracts involved.

The CBN’s total assets climbed to N117.6 trillion, up from N87.9 trillion in 2023, fuelled by a jump in Nigeria’s external reserves. Currency in circulation, deposits, and IMF-related liabilities also rose significantly.

READ ALSO: CBN makes profit in 2024 after N1.2 trillion loss in 2023

Despite the profit, the bank is still weighed down by large accumulated losses and shrinking equity, with group equity falling by half to N1.01 trillion.

The charts below show a breakdown of the numbers behind the CBN’s financial turnaround and other lingering concerns.

More Infographics

Support PREMIUM TIMES’ journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie – +2348098788999